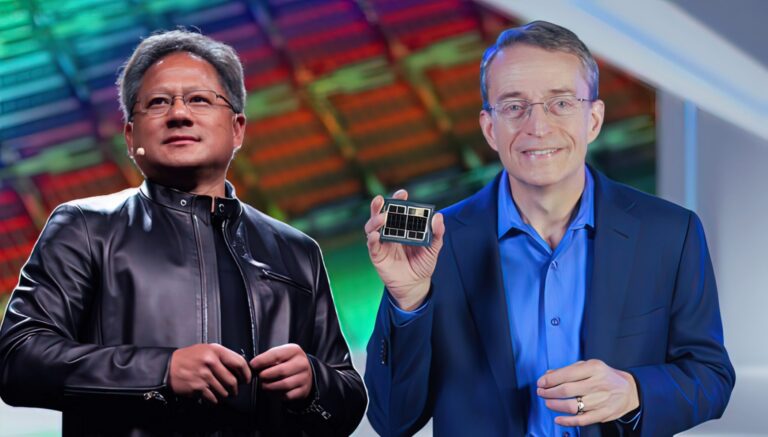

Intel’s former chief executive, Paul Otellini, reportedly presented the idea of acquiring NVIDIA in 2005, when the company was valued at just $20 billion.

Intel’s Business Fiasco Includes Missing Out On NVIDIA Acquisition Back In 2005, Company Didn’t Take Team Green Seriously

It is interesting how destiny decides to surprise us, as a new report by the New York Times claims that one of Intel’s executives had presented an idea to acquire NVIDIA almost 20 years ago, at the time when Team Green was in its initial stages, particularly in the design phase of graphics chips. According to the report, Paul Otellini, former Intel CEO, pitched the idea of buying NVIDIA in a board meeting with the intent that the design of graphics chips would be fundamental for data center scalability moving ahead; however, the idea was rejected.

While the reason for the rejection isn’t particular for now, it is assumed that Intel wasn’t too confident with mergers at all and that the $20 billion valuation back in 2005 would be pretty heavy on the firm’s pocket. So yeah, Intel could’ve turned up their $20 billion to a whopping $3.5 trillion in a matter of decades if they decided to acquire NVIDIA at that time, but the interesting question here is, would the merger, if it occurred, put NVIDIA at the position it currently is in?

You can’t blame Intel at all for losing the opportunity of a lifetime, given that AI wasn’t a thing back in 2005, and it was the start of the “graphics card” era, so putting a large bet on a mere Silicon Valley startup wouldn’t have been a wise move for…

Read full on Wccftech

Discover more from Technical Master - Gadgets Reviews, Guides and Gaming News

Subscribe to get the latest posts sent to your email.